SELECTED

ISSUE

|

|

Leisure Management - Crossing the watershed

Research

|

|

| Crossing the watershed

|

The Global Wellness Institute has taken a deep dive into

the economic status of the US$4.4tr global wellness economy.

Kath Hudson shares some of the fascinating insights

|

Spending in three world regions accounted for 90 per cent of the global wellness economy photo: shutterstock / margo basarab

|

|

|

A new report from the Global Wellness Institute (GWI), The Global Wellness Economy: Looking Beyond Covid updates the GWI’s previous reports in 2016 and 2018/19.

The new study was carried out by GWI senior research fellows and co-authors, Ophelia Yeung and Katherine Johnston, working alongside research fellow Tonia Callender.

“This research update is crucial, because 2020 is the watershed year that will forever divide history – and the trajectory of the growth of the wellness economy – into ‘before’ and ‘after’ COVID-19,” says Yeung.

“When we analyse how different wellness markets performed in the past year, it’s natural to want to compare them and label winners and losers. But there is no question that wellness – as a concept, as a lifestyle priority, and consumer value – is a big winner from the pandemic.”

|

The findings

• The team found the sector showed an annual growth rate of 6.6 per cent between 2017 and 2019, increasing in size from $413tr (€363tr, £309tr) in 2017 to $4.9tr (€4.37tr, £3.67tr) in 2019. In 2020 it fell by 11 per cent to $4.4tr (€3.93tr, £3.29tr). •

Asia-Pacific was one of the fastest-growing wellness markets from 2017 to 2019 (8.1 per cent growth). Buffered by high growth rates for wellness real estate, as well as public health, prevention and personalised medicine, it was the region that shrank the least during the pandemic (-6.4 per cent). •

While North America enjoyed the most growth between 2017 and 2019, it has also been one of the hardest hit by the pandemic (-13.4 per cent).

The Latin America-Caribbean regional wellness market saw the greatest decline (-22.1 per cent). •

From 2017 to 2019 the spa industry was growing at a rapid pace, but revenues fell by 38.6 per cent in 2020 to $68bn (€60.7bn, £51bn). It’s still difficult to assess the number of permanent business closures, but an estimated 22 new destination spas opened during 2020.

Hotspots

• Spending in three regions accounted for 90 per cent of the entire global wellness economy in 2020. Asia Pacific was the largest at $1.5tr (€1.34bn, £1.12bn); North America accounted for $1.3tr (€1.16tr, £970bn); and Europe stood at $1.1tr (€975bn, £830bn).

•

Per capita, spending on wellness is also significantly higher in North America $3,567 (€3,181, £2,670) and Europe $1,236 (€1,102, £925) than other regions of the world.

Changing fortunes

• Despite the pandemic, some sub-sectors of the wellness market expanded in 2020. Wellness real estate grew by 22.1 per cent. The market for mental wellness services expanded by 7.2 per cent, as people downloaded apps and bought accessories such as weighted blankets.

•

Public health, prevention and personalised medicine grew by 4.5 per cent. Healthy eating, nutrition and weight loss grew by 3.6 per cent, as people looked for supplements and foods which would boost their immunity. Although the physical activity sector shrank overall, the fitness technology sub-sector exploded by 29.1 per cent.

•

The lockdowns inevitably led to a contraction in some sectors. Personal care and beauty shrank by 13 per cent and spending on physical activity was down by 15.5 per cent as gyms were forced to close by governments.

•

Adversely affected by the travel restrictions and stay at home orders, wellness tourism was reduced by 39.5 per cent; spas lost 38.5 per cent and thermal springs were down by 38.9 per cent.

•

Those which took the greatest hit also have the highest growth projections. GWI predicts the global wellness economy will grow by 9.9 per cent annually, reaching $5tr (€4.46tr, £3.74tr) in 2021 and nearly $7tr (€6.24tr, £5.24tr) in 2025.

The number of people using the top three meditation apps grew by 59% in 2020 / photo: shutterstock / kite rin

Wellness tourism & spas

• The GWI research team found the global spa industry is heavily concentrated in Europe, Asia and North America, with the top five countries – US, China, Germany, Japan and France – accounting for 50 per cent of global revenues in 2020. The top 20 countries represent 78 per cent of the global market.

•

Asia-Pacific has the largest number of spas and Europe has the highest spa revenues. Day spas serving local customers were more buffered against pandemic-related decline than destination spas, which were hit by travel restrictions and saw the greatest revenue declines in 2020.

•

The wellness sectors most adversely affected by COVID-19 were those requiring a physical presence, so there was a drop in wellness tourism, with 601 million trips taken in 2020, compared to 936 million in 2019.

•

Europe recorded the largest number of wellness trips and North America leads in terms of expenditure. However, Asia-Pacific and the Middle East and North Africa were the fastest-growing regions prior to the pandemic.

Thermal/mineral springs

• Appealing to an expanding segment of customers seeking to connect with nature, experience cultural traditions and pursue alternative modalities for healing, rehabilitation and prevention, thermal springs were among the fastest-growing wellness sectors from 2017-2019. Revenues were growing by 6.8 per cent annually during this time but fell by 38.9 per cent from 2019-2020.

•

Asia-Pacific and Europe account for 96 per cent of revenues and 94 per cent of establishments in this sector. There were at least 115 new openings from 2018 to 2020 across every region: 17 in 2020 at least 25 in 2021 and there are more than 140 projects in the pipeline.

•

Not all thermal springs fared badly. In the US, China, Australia and New Zealand some reported growth in attendances of 10 to 20 per cent, as customers flocked to COVID-safe outdoor activities.

•

Indoor thermal facilities saw business decimated by restrictions. The sector is facing possible bankruptcy in Romania, due to long closures and insufficient government aid and in countries such as Slovenia, Italy and the Czech Republic, governments are offering state-subsidised vouchers to consumers to boost the sector.

Mental health

• The pandemic has changed how we view self-care, which has become a means for self-preservation and survival. Self-care is no longer something that is practised for an hour a day a few times a month, or on vacation. Self-care is becoming increasingly embedded into daily life via home-cooked meals, human connections, good sleep, time in nature, financial wellness, search for purpose, meaning and much more.

• With 15 per cent of the global population suffering from mental health issues and substance-use disorders, as well as rising numbers of cases of dementia, stress, worry, sadness, burnout and loneliness, it is a dire landscape for mental health.

• Mental wellness offers a path forward to help meet widespread needs and increase wellbeing for all. The number of people using the top three global meditation apps rose by 59 per cent in 2020.

•

Although the pandemic has caused more mental health issues, this has reduced the stigma of mental illness and has brought greater attention to ways of coping with adversity, improving resilience and moving towards flourishing.

Since the start of the pandemic, self-care has increasingly become embedded into daily life / photo: shutterstock / calistoga

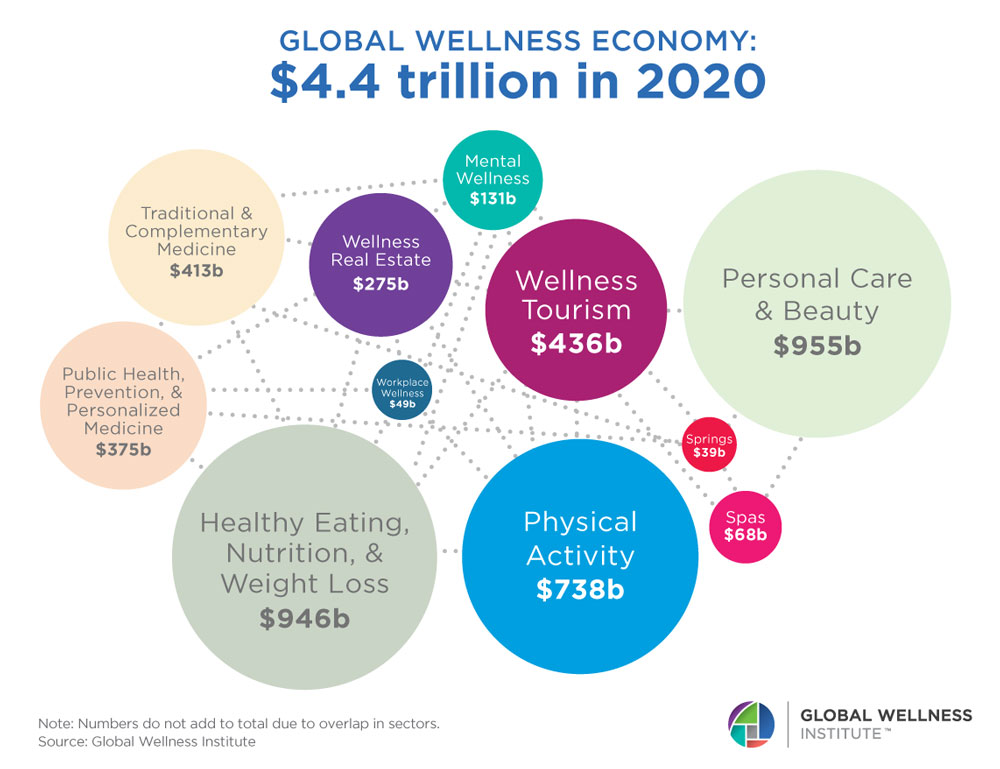

Fast facts: The Global Wellness Economy

The value of the 11 segments of the $4.4tr (€3.92tr, £3.29tr) global wellness industry assessed by the report – in order of value. (all $ are US$)

Traditional and complementary medicine $413bn (€363bn, £309bn)

Wellness real estate £275bn (€245bn, £206bn)

Mental wellness $131bn (€117bn, £98bn)

Wellness tourism $436bn (€389bn, £326bn)

Personal care and beauty $955bn (€852bn, £715bn)

Public health prevention and personalised medicine $375bn (€334bn, £281bn)

Workplace wellness $49bn (€44bn, £37bn)

Healthy eating, nutrition and weight loss $946bn (€844bn, £708bn)

Physical activity $738bn (€658bn, £552bn)

Spas $68bn (€61, £51bn)

Thermal/mineral springs $39bn (€35bn, £29bn)

Credit: The Global Wellness Economy: Looking Beyond Covid

Wellness travel

• The grey area between wellness tourism and medical tourism is growing as further services are added, such as DNA testing, executive checkups, hydrotherapy/balneotherapy, detoxes and cleanses.

• There’s movement in two directions when it comes to medical integration. The pandemic has accelerated the incorporation of medical offerings into spa and wellness businesses, while some medical spas are transforming their spaces to become less sterile and more spa-like.

• Wellness travel is likely to be boosted by a growing trend of people taking wellness sabbaticals or workcations. Some consumers are choosing hotels that promise to support their sleep, for example with soundproofing, circadian lighting, air filtration, and fitness facilities on-site.

•

There are indications the pandemic has accelerated demand for slow travel, transformative travel and regenerative travel. This is travel that’s goal-based and values-driven, involving personal growth and an awareness of the social and environmental impact of tourism on the destination.

•

We will see consumers questioning their own environmental and social footprints and making choices based on these concerns. The rising consumer appreciation of, and desire for, nature will push wellness businesses in a more regenerative and environmental direction.

Wellness travel will be boosted by people taking health sabbaticals / photo: shutterstock / alena ozerova

The Bounceback

• There are indications of a strong resurgence in demand for spa and wellness. Hunger for touch and human connections, travel and nature and wellness experiences is intense after all the social distancing, quarantining and staying at home. Guests are willing to have longer stays, spend more and try out new modalities.

• During lockdowns, research has been been conducted into brain health, the gut microbiome, sleep hygiene, breathwork, sound healing, nature and other modalities, which offer exciting potential moving forward.

photo: Ophelia Yeung

“This research update is crucial,

because 2020 is the watershed year

that will forever divide history” –

Ophelia Yeung, GWI senior research fellow

|

|

|

| Originally published in Spa Business 2021 issue 4

|

|

|

|